Understanding Money Transmitter Ripple: A Deep Dive into Its Functionality and Impact

Introduction to Ripple and Money Transmission

Ripple is a digital payment protocol and cryptocurrency designed to facilitate secure and efficient international money transfers. As the world increasingly shifts towards a digital economy, the need for effective money transmission solutions has gained significance. Traditional banking systems struggle with high fees, long processing times, and limited accessibility, especially in cross-border payments. Ripple emerges as a revolutionary solution to these challenges, harnessing blockchain technology to streamline the transfer of value across borders.

The primary function of Ripple is to act as a money transmitter, enabling financial institutions to conduct transactions almost instantly. Unlike conventional methods that may take several days to settle, transactions on the Ripple network can be completed in mere seconds. This remarkable speed is achieved due to Ripple’s unique consensus algorithm and its decentralized network of nodes which enhances both efficiency and security.

One of the significant advantages of Ripple technology is its ability to significantly reduce transaction costs. By minimizing intermediaries, Ripple allows direct transfers between parties, which ultimately leads to lower fees. This is particularly beneficial for businesses and consumers engaged in international trade, as it provides them with a cost-effective alternative to traditional banking channels. Additionally, the use of Ripple’s cryptocurrency, XRP, as a bridge currency facilitates liquidity in money transmission, further simplifying cross-border settlements.

In discussing the role of money transmitters, it is essential to highlight their impact on the global financial landscape. They play a crucial role in enabling financial inclusion by providing access to financial services in underbanked regions. Ripple’s innovative approach to money transmission is not only transforming how we think about international payments but also promoting a more inclusive financial ecosystem.

The Technology Behind Ripple

Ripple operates on a pioneering framework known as distributed ledger technology (DLT), which distinguishes it from traditional banking systems. At the core of Ripple’s functionality is the XRP Ledger, an open-source blockchain that facilitates the rapid and cost-effective transfer of currency and assets globally. Unlike conventional money transmission methods, which often rely on intermediaries, RippleNet offers a decentralized network that enables direct transactions between parties.

The RippleNet network employs a consensus protocol to validate transactions, which enhances its efficiency and security. This protocol allows nodes within the network to agree on the state of the ledger without the need for cumbersome mining processes, as seen in cryptocurrencies like Bitcoin. Instead, transactions are validated by a unique set of trusted validating servers that must reach consensus, ensuring that each transaction’s integrity is maintained. This mechanism significantly reduces transaction times and costs, making Ripple a competitive option for money transmitters and financial institutions alike.

In traditional banking systems, money transmission often involves multiple intermediaries, resulting in delays and higher fees for consumers. Ripple challenges this paradigm by streamlining the process; transactions can be completed in seconds, with fees typically remaining below a cent. This efficiency not only benefits the users but also transforms the overall landscape of global remittance and money transfers. By eliminating the need for multiple banks and settlement layers, Ripple’s approach presents a robust solution to the friction commonly experienced in money transmission today.

Ultimately, the combination of Ripple’s DLT and the XRP Ledger positions it as a groundbreaking alternative in the fintech space, poised to revolutionize how individuals and institutions handle currency transfers across borders.

Ripple’s Money Transmission Network

Ripple has established a robust money transmission network known as RippleNet, which connects a diverse array of financial institutions and money service businesses (MSBs) across the globe. This network enables institutions to conduct cross-border transactions with enhanced efficiency and reliability. RippleNet operates on a decentralized platform that utilizes blockchain technology, which facilitates the seamless transfer of value between participants while ensuring transparency and security.

At the core of RippleNet are its key members, which include established banks, payment providers, and MSBs, each of which contributes to an expansive ecosystem aimed at streamlining the process of money transmission. Notable participants in this network comprise both significant global banks and smaller regional players, which collectively enhance the system’s interoperability. This wide-ranging membership allows for greater liquidity and diverse transaction routes, ultimately improving the overall effectiveness of money transfers on a global scale.

Partnering with Ripple affords these financial institutions substantial benefits pertaining to cross-border transactions. One of the most significant advantages is the considerable reduction in costs associated with traditional money transmission methods. By leveraging Ripple’s technology, institutions can minimize transaction fees, which can often be burdensome in the conventional banking system. Moreover, RippleNet enables faster settlement times, often reducing transaction processing from days to mere seconds, thereby enhancing customer satisfaction and financial fluidity.

These advantages not only bolster the institutions involved but also contribute to a more integrated global economy. As more financial entities recognize the value of utilizing Ripple for money transmission, the ecosystem surrounding RippleNet continues to expand, resulting in enhanced options for consumers and businesses alike. This evolution exemplifies the potential of modern blockchain solutions in redefining the dynamics of finance and facilitating unprecedented levels of efficiency in money transmission.

Key Benefits of Using Ripple for Money Transmission

Ripple has emerged as a transformative money transmitter by leveraging blockchain technology to offer various benefits that appeal to businesses and individuals alike. One of the primary advantages of using Ripple is its cost efficiency. Traditional money transmission systems often incur high fees due to various intermediary banks involved in cross-border transactions. In contrast, Ripple facilitates direct transactions with minimal fees, allowing users to save on costs and increase profitability.

Another significant benefit of Ripple is the speed of transactions. Traditional money transfers can take several days to process, particularly when they cross international borders. Ripple, however, enables near-instantaneous transfers, allowing funds to be available in a matter of seconds. This speed is vital for businesses that need to efficiently manage cash flow and respond rapidly to market demands.

Scalability also stands out as a substantial advantage of using Ripple for money transmission. The Ripple network has been designed to handle a vast number of transactions simultaneously, making it an ideal solution for institutions that require a robust payment system. Large financial institutions, in particular, can utilize Ripple’s capabilities to scale their operations without facing the bottlenecks associated with traditional systems. For instance, Santander and American Express have successfully integrated Ripple’s technology to enhance their payment solutions, providing them with the ability to serve a broader customer base.

Security is paramount in any financial transaction, and Ripple incorporates advanced security features that ensure the safety of funds. The decentralized nature of blockchain technology means that transactions are transparent and immutable. This transparency fosters trust among users while mitigating risks commonly associated with centralized systems. Through real-life examples and case studies, it is evident that businesses adopting Ripple for their payment systems experience enhanced operational efficiency alongside superior security measures.

Challenges and Controversies Surrounding Ripple

Ripple, a prominent player in the cryptocurrency space, has emerged as a notable money transmitter, primarily due to its innovative technology and partnerships with financial institutions. However, the company is not without its challenges and controversies. One of the primary issues faced by Ripple pertains to regulatory scrutiny. The ongoing legal battle with the U.S. Securities and Exchange Commission (SEC) has raised significant concerns about the classification of Ripple’s native cryptocurrency, XRP. This has implications for its operational model as a money transmitter, compelling Ripple to navigate an intricate web of legal interpretations concerning securities and digital assets.

In addition to regulatory challenges, Ripple contends with formidable competition from various cryptocurrencies and blockchain solutions. Many of these alternative platforms are designed to perform similar functions as Ripple’s digital payment network, often boasting enhanced decentralization or other unique features. This competitive landscape poses continual pressure on Ripple to innovate and maintain its positioning as a reputable money transmitter in a rapidly evolving market.

Another point of contention revolves around the degree of decentralization associated with Ripple. Critics argue that Ripple’s network leans towards centralization due to its consensus mechanism and the significant holdings of XRP by Ripple Labs. This perception raises questions about the integrity of its operations as a money transmitter, especially given the principles of decentralization that underpin many cryptocurrencies. These factors combine to create a complex environment in which Ripple operates, requiring the company to adeptly manage regulatory challenges, competition, and internal governance issues while maintaining its commitment to revolutionizing cross-border payments.

The Role of XRP in Ripple’s Money Transmission

XRP serves as the native cryptocurrency of Ripple, functioning as a key component in the firm’s approach to enable efficient money transmission across borders. By utilizing XRP in its network, Ripple facilitates liquidity for financial institutions, allowing them to lower the costs associated with international remittances. Traditional money transmission systems often rely on pre-funding accounts in various countries, which can result in substantial capital tied up in non-earning assets. This is where XRP comes into play, serving as a bridge currency that enhances liquidity while minimizing the need for such capital allocation.

The utilization of XRP allows for the instantaneous conversion of one currency to another, drastically reducing transaction times from several days to mere seconds. This enhanced speed not only improves the overall user experience but also contributes to cost efficiency by decreasing the fees associated with cross-border transactions. By leveraging the efficiency of XRP, institutions are better positioned to offer their customers lower transaction fees, thereby encouraging greater participation in the global economy.

However, the classification of XRP has stirred debate among regulators and users alike. Some classify XRP as a cryptocurrency, while others argue that it behaves more like a security due to its centralized control by Ripple Labs. This classification has potential implications for both users and businesses involved in money transmission. If deemed a security, XRP would face stringent regulatory scrutiny, which could hamper its widespread adoption and usage in the financial field. This ongoing debate not only affects marketplace perceptions but also influences investment decisions regarding the cryptocurrency.

In conclusion, XRP plays a pivotal role in Ripple’s money transmission framework by enhancing liquidity and reducing transaction costs. The continuous discussions surrounding its classification highlight the complexities of integrating cryptocurrency into traditional financial systems and the need for clearer regulatory standards.

Comparison with Other Money Transmitters

In recent years, various money transmitters and digital payment systems have emerged, each offering distinct advantages and challenges. This section will explore how Ripple compares with notable competitors such as SWIFT, Bitcoin, and stablecoins in terms of transaction speed, cost, security, and global reach.

To begin with, transaction speed is a critical factor in the money transmission market. Ripple stands out with its ability to settle transactions in 3 to 5 seconds, significantly faster than traditional systems like SWIFT, which can take several days to finalize a transaction. In contrast, Bitcoin, while revolutionary, typically requires a minimum of 10 minutes for confirmation due to its blockchain processing. This makes Ripple particularly advantageous for institutions needing swift cross-border transactions.

When assessing costs associated with these systems, Ripple’s infrastructure allows for significantly lower transaction fees, often costing only a fraction of a cent per transaction. In comparison, SWIFT charges hefty fees that can vary widely, depending on factors such as transaction size and destination. Bitcoin’s fees can also fluctuate, especially during periods of network congestion, making it less predictable. Therefore, Ripple emerges as a cost-effective solution for money transmission.

Security is another crucial aspect in the analysis of money transmitters. Ripple employs advanced cryptography and a decentralized network, which enhances its security features. Unlike Bitcoin, which can be vulnerable to market volatility and hacking incidents, Ripple’s protocol offers a more stable environment for transactions. Meanwhile, stablecoins provide a hybrid option, aiming to capitalize on the stability of fiat currencies while benefitting from blockchain technology.

Lastly, global reach remains vital in comparing these transmissions. Ripple has formed numerous partnerships with financial institutions worldwide, thereby enhancing its ability to facilitate international transactions. Whereas Bitcoin and other cryptocurrencies are often subject to regulatory scrutiny, Ripple’s collaborations with banks position it uniquely to navigate the global landscape as a trusted money transmitter.

In conclusion, Ripple’s combination of speed, cost-efficiency, security, and broad global partnerships solidifies its position as a formidable player in the money transmission market, effectively distinguishing it from other money transmitters like SWIFT and Bitcoin.

Future of Ripple as a Money Transmitter

The landscape of digital payments is rapidly evolving, and Ripple is strategically positioned within this dynamic environment as a significant money transmitter. As financial institutions increasingly seek efficient solutions for cross-border transactions, Ripple has focused on creating innovative technologies designed to enhance transaction speed and reduce costs. Predictions indicate that Ripple can further expand its reach and influence in the global payment network, thus reaffirming its role as a leading money transmitter.

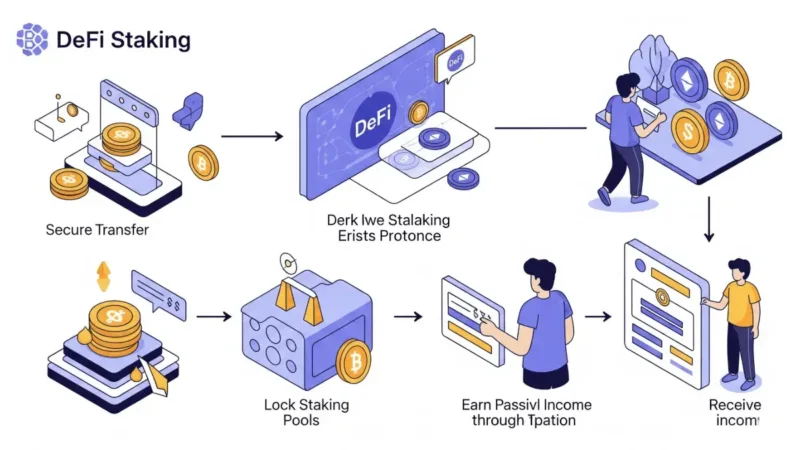

One of the most notable trends impacting the future of Ripple is the increasing demand for decentralized finance (DeFi) solutions. As traditional banking systems are often hindered by legacy infrastructure, Ripple’s blockchain technology offers a promising alternative, allowing for near-instantaneous transactions without the need for intermediaries. This shift could reshape how businesses and consumers transact, providing Ripple an opportunity to capture a larger market share within the money transmitter domain.

Moreover, the proliferation of digital currencies and stablecoins indicates a growing acceptance of alternative payment methods. With Ripple’s ability to integrate digital assets within its platform, it may leverage this trend to strengthen its offerings in the money transmission market. Strategic partnerships with financial institutions and cryptocurrencies are also expected to influence Ripple’s future, facilitating broader adoption and ensuring compliance with regulatory requirements.

Regulatory changes will play a crucial role in shaping Ripple’s trajectory as a money transmitter. Keeping abreast of global regulatory developments will be essential for Ripple to maintain its competitive edge and ensure seamless integration into various markets. The ability to adapt not only to evolving compliance norms but also to technological advancements will determine Ripple’s sustained relevance in the digital payments sector.

In conclusion, the future of Ripple as a money transmitter appears promising, with significant potential for growth through technology, partnerships, and adaptability to regulatory landscapes. The ongoing evolution of digital payment trends will likely dictate the shape of Ripple’s continued emergence in this vital industry.

Stay informed, read the latest crypto news in real time!

Conclusion

Ripple has emerged as a prominent player in the money transmitter landscape, revolutionizing how cross-border transactions are conducted. By leveraging its unique technology, Ripple offers financial institutions a more efficient and cost-effective way to facilitate currency exchanges. This innovative approach not only accelerates transaction times but also eliminates the need for multiple intermediaries, ultimately benefiting both businesses and consumers.

Throughout this blog post, we explored Ripple’s functionality, highlighting its distinctive consensus algorithm which sets it apart from traditional money transmitters. Unlike conventional money transfer systems, Ripple operates on a decentralized network that ensures swift and secure transactions without excessive fees. This makes Ripple an attractive option for banks and financial entities seeking to enhance their remittance services.

Moreover, Ripple’s importance is underscored by its ability to adapt to regulatory changes and market demands. As attention towards digital currencies and blockchain technology increases, the role of money transmitters like Ripple will undoubtedly gain further significance. It is vital for stakeholders within the financial ecosystem to stay abreast of the evolving regulatory landscape and technological advancements surrounding Ripple. Such vigilance will not only enable compliance but also foster innovative practices that align with the future of money transmission.

In essence, by understanding the operational nuances of Ripple and its impact on the money transmitter industry, one gains insight into the future of global monetary exchanges. As we witness continued advancements in technology and shifts in regulatory frameworks, following developments in Ripple and similar entities will be crucial for anyone engaged in finance, banking, or international commerce.