DeFi Staking Guide 2025: Earn Passive Crypto Income

Many of us are familiar with the exhilarating highs and lows of trading cryptocurrencies. We watch charts, follow market news, and try to time our entries and exits. But what if there was a way to earn a steady income from your crypto holdings without the constant stress of active trading? Enter DeFi staking – a revolutionary concept within decentralized finance that’s empowering crypto holders to earn passive rewards by contributing to the security and operations of blockchain networks.

Decentralized finance, or DeFi, is reshaping the traditional financial landscape by offering open, permissionless, and transparent alternatives to banking, lending, and trading. At its core, DeFi staking involves “locking up” your crypto assets within a smart contract to support the functions of a blockchain network. In return for your commitment, you receive rewards, often in the form of additional tokens. It’s akin to earning interest on a savings account, but with potentially much higher yields and the added benefit of directly supporting the decentralization of digital ecosystems.

Understanding the Mechanics: How DeFi Staking Works

At its essence, DeFi staking is built upon the Proof of Stake (PoS) consensus mechanism, a more energy-efficient alternative to Bitcoin’s Proof of Work (PoW). In a PoS system, instead of powerful computers solving complex puzzles (mining), validators are chosen to create, propose, and vote on new blocks based on the amount of cryptocurrency they’ve “staked” or locked up.

When you participate in DeFi staking, you’re essentially lending your tokens to a DeFi protocol or a blockchain, contributing to its security and liquidity. These locked assets enable various functions, such as validating transactions, securing the network, or facilitating lending and borrowing activities within a decentralized application (dApp).

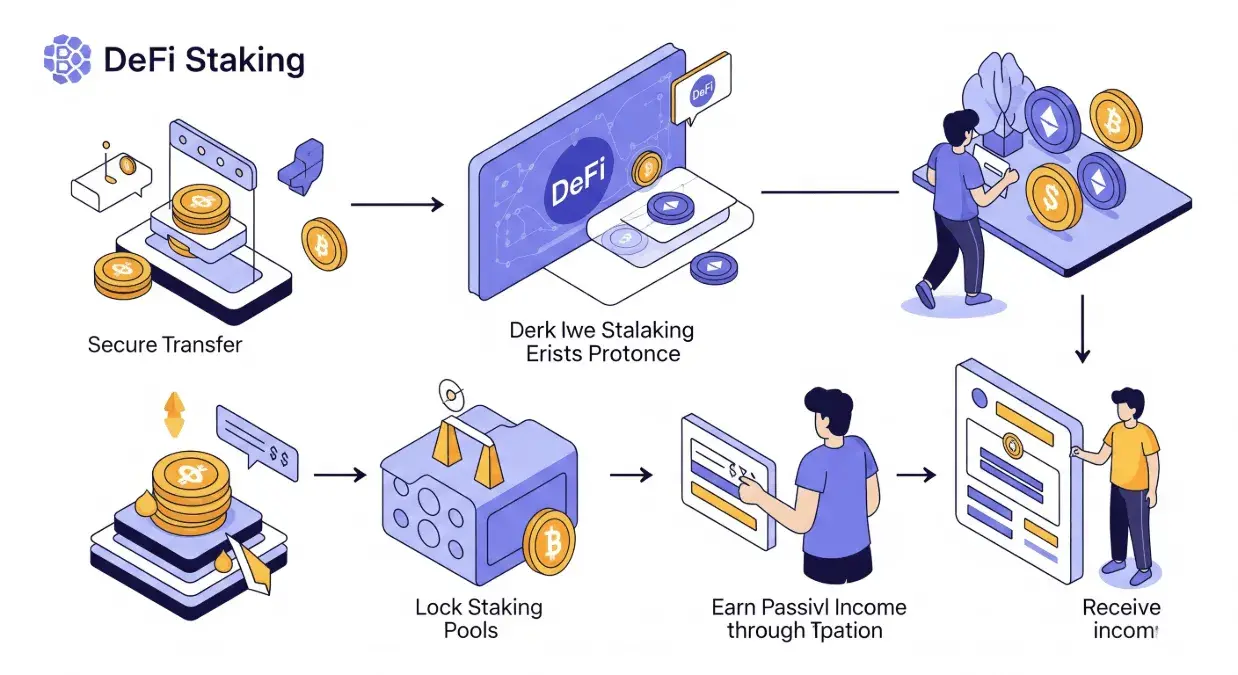

The process typically involves a few simple steps:

- Choosing a Platform: Select a reputable DeFi staking platform or a specific DeFi protocol.

- Depositing Assets: Connect your compatible crypto wallet (like MetaMask) and deposit the desired crypto assets into the protocol’s smart contract.

- Locking Period (Optional): Depending on the platform, you might choose a fixed lock-up period or a more flexible option. Longer lock-up periods often yield higher rewards.

- Earning Rewards: As long as your assets are staked, you’ll continuously accrue rewards, usually in the native token of the protocol or in the staked asset itself. These rewards can often be compounded, further boosting your earnings over time.

Why DeFi Staking Matters: Key Benefits and Impact

DeFi staking offers a compelling array of advantages for both individual investors and the broader blockchain ecosystem:

- Passive Income Generation: This is arguably the most attractive benefit. Staking allows you to earn consistent rewards on your idle crypto assets, transforming them from speculative holdings into a source of ongoing income. Potential returns often range from 5% to over 20% annually, significantly outperforming traditional savings accounts.

- Enhanced Network Security and Stability: By staking your tokens, you directly contribute to the security and integrity of the underlying blockchain network. The more assets staked, the more robust and resilient the network becomes against malicious attacks. This also incentivizes stakers to act honestly, as bad behavior can result in “slashing” – the loss of a portion of their staked assets.

- Governance Participation: Many DeFi protocols empower their stakers with governance rights. This means your staked tokens can give you voting power on key decisions regarding the protocol’s future, such as upgrades, fee structures, and even the allocation of funds. This democratic aspect fosters a strong sense of community and ownership.

- Lower Barriers to Entry: Unlike traditional investment vehicles that often require substantial capital or complex procedures, DeFi staking is remarkably accessible. With just a compatible crypto wallet and an internet connection, almost anyone can participate, making financial empowerment more inclusive.

- Diversification of Investment Portfolio: Staking allows you to expand your crypto portfolio beyond just trading. By engaging with different protocols and staking various cryptocurrencies, you can diversify your risk and create multiple streams of passive income.

Common Mistakes and Myths to Avoid

While appealing, DeFi staking isn’t without its caveats. Being aware of potential pitfalls is crucial for a successful experience.

- “DeFi staking is entirely risk-free.” This is a dangerous myth. While rewards can be enticing, risks exist.

- Smart Contract Vulnerabilities: The code that governs staking is a smart contract. If there’s a bug or exploit in the code, your staked funds could be at risk. Always prioritize audited and well-established protocols.

- Impermanent Loss (in Liquidity Pools): While strictly speaking, staking usually refers to locking tokens to secure a PoS network, some associate it with providing liquidity to decentralized exchanges (DEXs), which is often called “yield farming.” If you provide liquidity, you face impermanent loss, where the value of your deposited assets changes relative to each other, potentially leading to a loss compared to simply holding them. It’s crucial to understand the distinction.

- Price Volatility: The value of your staked crypto can still fluctuate. If the token you’re staking significantly drops in price, your overall investment value might decrease even if you’re earning rewards.

- Lock-up Periods and Illiquidity: Some staking options require you to lock your assets for a specific period. During this time, you won’t be able to access your funds, even if market conditions change unfavorably.

- “Higher APY always means better.” While a high Annual Percentage Yield (APY) is attractive, unsustainable APYs often signal higher risk. Projects offering excessively high returns might be new, unproven, or have tokenomics that lead to rapid inflation and devaluation. Always conduct thorough due diligence.

- Neglecting Research: Don’t jump into staking without understanding the protocol, its team, its security audits, and its community sentiment. A little research can save you from significant losses. As the renowned crypto investor and entrepreneur, Balaji Srinivasan, once remarked, “Code is law, but the community is the constitution.” Understanding the community and governance of a protocol is as vital as understanding its code.

Recommendations and Tips for a Smooth Staking Journey

To maximize your returns and minimize risks, consider these practical recommendations:

- Start Small and Diversify: If you’re new to DeFi staking, begin with a small amount of capital you’re comfortable losing. As you gain experience, gradually increase your stake and diversify across different reputable protocols and cryptocurrencies.

- Prioritize Established Platforms: Look for platforms with a proven track record, a strong community, and multiple security audits. Projects like Lido Finance (for Ethereum staking), Aave (for lending/borrowing with staking options), and PancakeSwap (for BNB Chain) are widely recognized.

- Understand the Risks: Be fully aware of the specific risks associated with each staking opportunity. This includes smart contract risk, impermanent loss (if providing liquidity), and the volatility of the underlying asset.

- Monitor Your Positions: The crypto market is dynamic. Keep an eye on the market conditions, protocol updates, and your staking rewards.

- Secure Your Wallet: Your crypto wallet is your gateway to DeFi. Use a hardware wallet for larger sums, enable two-factor authentication (2FA) wherever possible, and never share your seed phrase.

Looking Ahead: The Future of DeFi Staking

DeFi staking is continuously evolving, with innovations like liquid staking and restaking gaining significant traction. Liquid staking, offered by platforms like Lido, allows you to stake your assets while receiving a liquid token representing your staked amount. This derivative token can then be used in other DeFi protocols, providing even greater capital efficiency. Restaking, as seen with protocols like EigenLayer, takes this a step further, allowing staked ETH to be reused to secure other decentralized networks, potentially earning additional rewards.

These trends signify a maturing ecosystem where users are not only incentivized to secure networks but also to maximize the utility of their staked assets. As DeFi continues to innovate, staking will remain a cornerstone, offering a compelling path to passive income and active participation in the decentralized financial revolution.

[Explore other articles on cryptonewsarea.com to deepen your understanding of the broader DeFi landscape, including our guide to understanding yield farming and our breakdown of the latest trends in decentralized exchanges.]