Stablecoin Adoption Explodes: Active Wallets Surge 53%, Supply Hits $225 Billion

The cryptocurrency landscape is witnessing a seismic shift, driven by the phenomenal growth of stablecoin adoption. A groundbreaking report, “The State of Stablecoins 2025: Supply, Adoption & Market Trends,” published by Artemis and Dune, reveals an unprecedented surge in the adoption of these digital assets, painting a picture of a financial revolution in progress.

In just one year, from February 2024 to February 2025, the number of active stablecoin wallets skyrocketed by an astonishing 53%, rising from 19.6 million to over 30 million. This explosive growth underscores the increasing reliance on stablecoins as a crucial component of the digital economy.

But the growth doesn’t stop there. The total supply of stablecoins has also seen a dramatic increase, surging by 63% to reach a staggering $225 billion. Furthermore, the monthly transaction volume has more than doubled, climbing by 115% to exceed $4.1 trillion. These figures paint a clear picture of the burgeoning influence of stablecoins in the financial world.

Driving Forces Behind the Stablecoin Boom

Several key factors are fueling this remarkable growth. Firstly, stablecoins are increasingly being used for digital payments, offering a stable and secure alternative to traditional payment methods. The stability of these digital assets, pegged to fiat currencies like the US dollar, makes them ideal for everyday transactions, especially in regions with volatile local currencies.

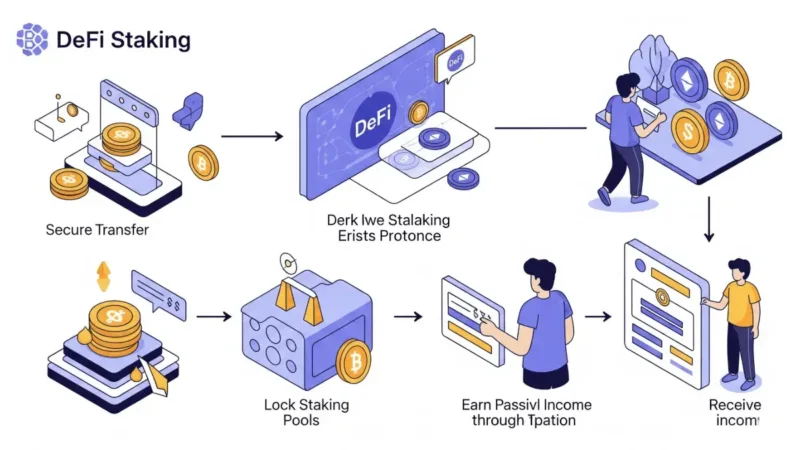

Secondly, the decentralized finance (DeFi) sector has played a pivotal role in driving stablecoin adoption. Stablecoins serve as the backbone of DeFi, facilitating lending, borrowing, and trading on decentralized platforms. Their stability provides a reliable medium of exchange, mitigating the volatility inherent in other cryptocurrencies.

Thirdly, and perhaps most significantly, traditional financial institutions are increasingly recognizing the potential of stablecoins. More companies and governments are exploring these digital assets as efficient solutions for cross-border transfers, protection against volatility, and access to decentralized financial markets. This growing institutional interest is a testament to the maturing role of stablecoins in the global financial system.

The Bridge Between Traditional Finance and Crypto

The report highlights that stablecoins are solidifying their position as the bridge between traditional finance and the crypto ecosystem. Their stability and efficiency make them an attractive option for both retail and institutional investors. The ability to seamlessly move value across borders and access decentralized financial services is transforming the way we think about money.

Increased Security and Stability

One of the primary drivers of stablecoin adoption is the perceived stability and security they offer. Unlike volatile cryptocurrencies like Bitcoin or Ethereum, stablecoins are pegged to stable assets, providing a level of predictability that is essential for mainstream adoption.

This stability is particularly appealing in regions experiencing economic instability or hyperinflation. Stablecoins offer a safe haven, allowing individuals to protect their wealth from the erosion of purchasing power.

Cross-Border Transactions and Remittances

The efficiency of stablecoins in facilitating cross-border transactions and remittances is another significant factor driving their adoption. Traditional cross-border payments can be slow, expensive, and cumbersome. Stablecoins, on the other hand, offer near-instantaneous and low-cost transfers, making them an attractive alternative for individuals and businesses alike.

This efficiency is particularly beneficial for migrant workers sending remittances back home. Stablecoins can significantly reduce the costs and delays associated with traditional remittance services, ensuring that more money reaches its intended recipients.

Institutional Adoption and Regulatory Clarity

The growing interest from traditional financial institutions is a clear indication of the maturing role of stablecoins. Banks, payment processors, and other financial institutions are exploring the use of stablecoins for a variety of applications, including cross-border payments, treasury management, and settlement.

However, regulatory clarity is crucial for widespread institutional adoption. Governments and regulatory bodies around the world are grappling with the challenges of regulating stablecoins. Clear and consistent regulations are needed to provide a level playing field and ensure the safety and stability of the financial system.

The Future of Stablecoins

The future of stablecoins looks bright. As technology advances and regulatory frameworks evolve, we can expect to see even greater adoption of these digital assets. The increasing use of stablecoins in digital payments, DeFi, and institutional finance is transforming the financial landscape.

The continued increase in stablecoin adoption is a clear indicator that stablecoins are here to stay. They are not just a passing fad but a fundamental component of the emerging digital economy.

The Role of Technology and Innovation

Technological advancements are playing a crucial role in driving the adoption of stablecoins. Innovations in blockchain technology, smart contracts, and decentralized applications are making stablecoins more accessible, efficient, and secure.

The development of new stablecoin protocols and platforms is also contributing to the growth of the ecosystem. These innovations are making it easier for individuals and businesses to use stablecoins for a variety of purposes.

Impact on Emerging Markets

Emerging markets are likely to benefit significantly from the widespread adoption of stablecoins. These digital assets can provide access to financial services for the unbanked and underbanked populations, fostering financial inclusion and economic development.

In regions with volatile local currencies, stablecoins can offer a stable store of value, protecting individuals from the erosion of their wealth. The efficiency of stablecoins in facilitating cross-border transactions can also boost trade and investment in emerging markets.

Challenges and Opportunities

Despite the rapid growth and widespread adoption of stablecoins, several challenges remain. Regulatory uncertainty, security risks, and scalability issues are among the key challenges that need to be addressed.

However, these challenges also present opportunities for innovation and development. The ongoing efforts to improve the security, scalability, and regulatory compliance of stablecoins are paving the way for their widespread adoption.

The reports findings solidify that stablecoin adoption is a long term trend. The current growth is not a bubble.

The sheer increase in monthly transaction volume shows that stablecoin adoption is more than just wallet numbers, people are actively using them.

The fact that stablecoin adoption is growing so quickly is a sign that the public is ready for more crypto based solutions.

The report also shows that stablecoin adoption is not just a retail trend, but also an institutional one.

The numbers are clear, stablecoin adoption is here to stay.

The continued rise of stablecoin adoption is a testament to the power of blockchain technology.

The growing stablecoin adoption numbers are a clear indicator of the future of finance.

The continued progress of stablecoin adoption will change the world.

The future of finance is showing us that stablecoin adoption is a vital part of the future.

Stay informed, read the latest crypto news in real time!

Conclusion

The explosive growth of stablecoins, as highlighted in the Artemis and Dune report, is a testament to their increasing importance in the global financial system. With active wallets surging, supply reaching record highs, and transaction volumes skyrocketing, stablecoins are solidifying their position as a crucial bridge between traditional finance and the crypto ecosystem. As technology advances and regulatory frameworks evolve, we can expect to see even greater adoption of these digital assets, transforming the way we think about money and finance.