Tokenized Treasuries Skyrocket, BlackRock’s BUIDL Leads Explosive Growth

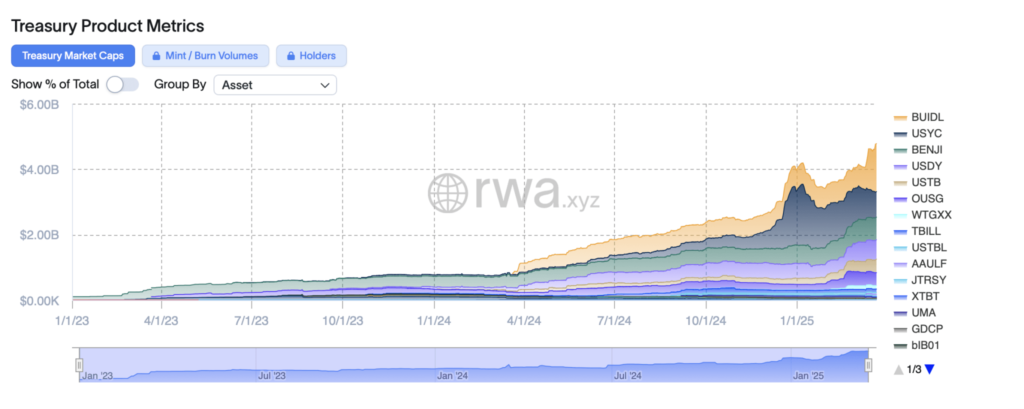

The world of finance is undergoing a profound transformation, and at the forefront of this revolution are Tokenized Treasuries. Over the past year, these digitized representations of traditional Treasury funds have experienced a staggering 566% surge in value, signaling a seismic shift in how assets are managed and traded. By March 2024, the market capitalization of these innovative financial instruments stood at a respectable $716 million. However, the ensuing months have witnessed an extraordinary acceleration, pushing the market to an impressive $4.77 billion.

Explosive Growth and Market Dynamics

This explosive growth is not merely a statistical anomaly; it represents a fundamental reshaping of the financial landscape. Notably, the sector has added a remarkable $720 million since March 4, 2025, underscoring the accelerating momentum and the growing confidence in the technology underpinning these assets. The rapid expansion highlights the increasing adoption of blockchain technology within traditional financial markets, as investors seek enhanced efficiency, transparency, and accessibility.

From March 2024 to now, tokenized Treasuries have experienced a meteoric 566% rise in growth over the past 12 months. Source: rwa.xyz

BlackRock’s BUIDL: A Cornerstone of Transformation

Much of this recent expansion can be attributed to the influential presence of BlackRock’s BUIDL, issued by Securitize. This fund has emerged as a cornerstone of the transformative trend, demonstrating the immense potential of tokenization in bridging the gap between traditional finance and the burgeoning world of digital assets. Eight days ago, Bitcoin.com News highlighted BUIDL’s milestone of breaching the $1 billion threshold, with the fund’s holdings pegged at $1.004 billion. Fast forward to March 22, and the fund’s value has climbed to an impressive $1.467 billion, reflecting a substantial $463 million uptick. This surge underscores the robust demand for secure, yield-bearing digital assets and BlackRock’s strategic positioning in this burgeoning market.

Competitive Landscape: Hashnote and Franklin Templeton

In the competitive landscape of Tokenized Treasuries, Hashnote’s Short Duration Yield Coin (USYC) fund occupies the runner-up position. Eight days ago, USYC boasted $868 million in assets under management (AUM). However, the fund has since experienced an $84 million reduction, bringing its AUM to approximately $784 million as of this weekend. This fluctuation highlights the inherent volatility and competitive dynamics within the sector.

Conversely, Franklin Templeton’s Onchain U.S. Government Money Fund has maintained a steady trajectory since our March 14 report, showing no significant fluctuations. This stability underscores the fund’s conservative approach and its focus on providing consistent, reliable returns.

Broader Market Growth: Ondo and Superstate

Beyond these major players, March has also brought notable growth to Ondo’s U.S. Dollar Yield (USDY) and Superstate’s Short Duration U.S. Government Securities Fund (USTB), further amplifying the dynamism of the sector. Ondo’s fund has grown from $563 million to $593 million, while Superstate’s USTB has swelled from $310 million to $393 million. These increases reflect the broader trend of increasing investor interest in Tokenized Treasuries and the growing recognition of their potential to deliver stable yields in a digital format.

Blockchain’s Efficiency and Transparency

The fundamental appeal of Tokenized Treasuries lies in their ability to streamline settlement and redemption processes, leveraging the inherent efficiencies of blockchain technology. Traditional Treasury funds often involve complex and time-consuming administrative procedures, but tokenization simplifies these processes, enabling faster and more transparent transactions. This efficiency has magnetized a growing influx of capital into the sector, a trend that shows no signs of slowing down.

Blockchain’s ability to provide real-time transparency and reduce counterparty risk further enhances the attractiveness of Tokenized Treasuries. By recording transactions on an immutable ledger, blockchain technology ensures that all stakeholders have access to accurate and verifiable information. This transparency builds trust and confidence, attracting institutional investors who prioritize security and regulatory compliance.

Convergence of Traditional and Decentralized Finance

The rapid growth of the Tokenized Treasuries market also reflects the increasing convergence of traditional finance and decentralized finance (DeFi). As institutional investors become more comfortable with blockchain technology, they are exploring new avenues for asset management and yield generation. Tokenized Treasuries offer a compelling value proposition, providing a regulated and secure pathway to access the benefits of blockchain technology.

Regulatory Evolution and Future Outlook

Moreover, the regulatory landscape surrounding Tokenized Treasuries is evolving, with regulators increasingly recognizing the potential of these assets to enhance market efficiency and stability. As regulatory clarity improves, we can expect to see further institutional adoption and market growth.

The explosive growth of Tokenized Treasuries is not merely a fleeting trend; it represents a fundamental shift in the financial industry. The ability to tokenize traditional assets and leverage blockchain technology opens up new possibilities for asset management, trading, and investment. As the market continues to mature and regulatory frameworks become clearer, we can expect to see even greater adoption and innovation in this space.

Democratization of Institutional Assets

The accessibility that the Tokenized Treasuries provide to a broader audience is also a huge factor in the growth. By making typically institutional only assets available to more people, the blockchain is making a more equitable financial system.

Stay informed, read the latest crypto news in real time!

Conclusion

In conclusion, the meteoric rise of Tokenized Treasuries underscores the transformative potential of blockchain technology in the financial sector. With BlackRock’s BUIDL leading the charge and other funds experiencing significant growth, the momentum behind Tokenized Treasuries is undeniable. As the market continues to evolve, we can expect to see even greater innovation and adoption, reshaping the future of finance.