Bitcoin Price Prediction 2026: Bull Run or Bear Market Bottom?

TL;DR: Key Takeaways for Bitcoin Price Prediction 2026

- Current Price Action: Bitcoin is navigating a post-peak correction, currently stabilizing between $65,000 and $75,000 in early 2026.

- Bull Case: Analysts from firms like Bernstein and Standard Chartered target a recovery toward $150,000 by year-end, driven by a “tokenization super-cycle.”

- Bear Case: Technical patterns suggest a potential “Wave C” correction that could retest the $58,000 support level before a sustained bounce.

- Macro Catalyst: Expected Federal Reserve rate cuts in mid-2026 are likely to flood the market with liquidity, benefiting BTC as a “non-yielding” store of value.

- Market Sentiment: The “Fear & Greed Index” remains in a cautious zone, signaling a massive re-accumulation phase for long-term investors.

The cryptocurrency landscape in 2026 is vastly different from the retail-driven markets of the past. As we move deeper into this year, investors are asking one central question: where is the bottom? After the 2024 halving led to a staggering all-time high of approximately $126,000 in late 2025, the market has entered a sophisticated correction phase. This bitcoin price prediction 2026 aims to dissect the technical indicators, institutional flows, and macroeconomic factors that will define the King of Crypto over the next 12 months.

The State of the Bitcoin Market in 2026

As of February 2026, Bitcoin is navigating what many analysts call the “Institutional Consolidation Era.” Unlike previous cycles where the post-halving year was followed by an 80% crash, the current btc price forecast 2026 suggests a much more resilient market structure. The presence of Spot Bitcoin ETFs and corporate treasury adoption has created a “floor” that was non-existent in 2018 or 2022.

Historical Context: The 4-Year Cycle

Historically, Bitcoin follows a quadrennial rhythm dictated by the halving. In the current cycle:

- April 2024: The Halving reduced rewards to 3.125 BTC.

- October 2025: Bitcoin peaked at a record high of $126,200.

- February 2026: Prices are finding stability in the $68,000–$72,000 range.

While some fear a “crypto winter,” the bitcoin price prediction 2026 remains optimistic due to diminishing sell-side pressure from miners and the increasing scarcity of liquid supply on exchanges.

BTC Technical Analysis: Key Levels to Watch

For those looking at the charts, the btc technical analysis for mid-2026 highlights several critical zones. The Elliott Wave theory suggests we are currently in a corrective “Wave C.”

Support and Resistance Zones

- Ultimate Support ($55,000 – $58,000): This is the “must-hold” level for bulls. A drop below this would invalidate the current macro-bullish structure.

- Psychological Resistance ($80,000): Breaking back above this level would signal that the correction is over.

- The 200-Day Moving Average: Currently acting as a dynamic ceiling, a definitive daily close above this line is essential for a positive bitcoin future price outlook.

If the market maintains its current trajectory, our bitcoin price prediction 2026 suggests a period of “sideways accumulation” through the summer, followed by a potential rally in Q4 as global liquidity begins to expand again.

Factors Influencing the Bitcoin Future Price

Predicting the bitcoin future price requires more than just looking at charts; we must look at the “Oxygen” of the market: Liquidity.

Macroeconomic Tailwinds

In 2026, Bitcoin has matured into a macro asset. It now responds more to Federal Reserve interest rate decisions than to small-scale retail hype. If central banks pivot toward quantitative easing to stimulate slowing economies, the bitcoin prediction next year (2027) could see a return to six-figure territory.

The Rise of Bitcoin L2s

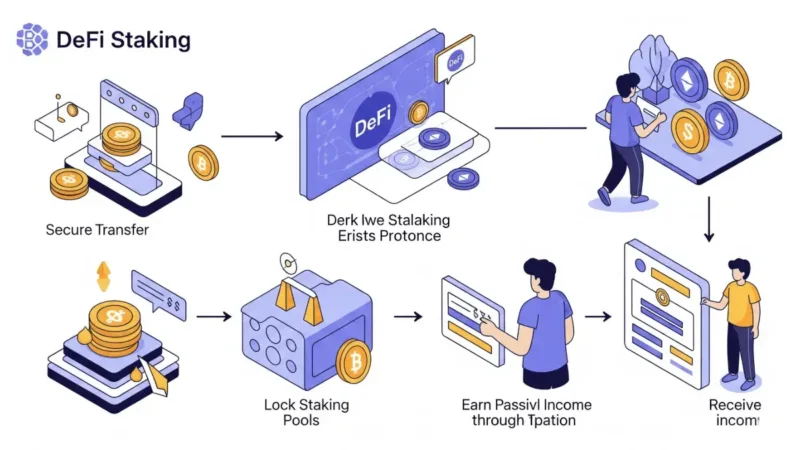

The narrative of 2026 isn’t just about “Digital Gold.” The emergence of functional Layer 2 solutions on Bitcoin, such as Stacks and BitVM, has added a utility premium. As Bitcoin becomes a settlement layer for decentralized finance (DeFi), the demand for BTC as collateral increases, supporting a bullish bitcoin price prediction 2026.

Expert Opinions: Bullish vs. Bearish 2026

The bitcoin market outlook is currently divided into two main camps:

The “Tokenization Super-Cycle” (Bullish)

Analysts at Bernstein and Standard Chartered argue that the integration of real-world assets (RWA) onto the blockchain is driving a structural supply shock. Their bitcoin price prediction 2026 targets a range between $150,000 and $175,000.

The “Cyclical Correction” (Bearish)

Skeptics like Youwei Yang (Bit Mining) warn that if macro conditions tighten, Bitcoin could end the year as low as $75,000. This btc price forecast 2026 suggests that the “easy money” of 2025 has been made, and 2026 will be a year of survival of the fittest.

Bitcoin Prediction Next Year: Looking Toward 2027

While we focus on 2026, it is vital to keep an eye on the bitcoin prediction next year. Most long-term models suggest that the period leading up to the 2028 halving will be characterized by steady accumulation. By 2027, many experts anticipate the “supply squeeze” will be fully felt, potentially pushing prices toward $200,000.

The bitcoin market outlook for late 2026 remains tied to institutional adoption. If more Fortune 500 companies follow MicroStrategy’s lead, the bitcoin price prediction 2026 could see a parabolic finish.

Stay informed, read the latest crypto news in real time!

Summary: Is 2026 a Good Year to Buy?

Based on our comprehensive bitcoin price prediction 2026, this year represents a classic “re-accumulation” phase. For long-term “HODLers,” periods of price stagnation or moderate corrections are historically the best times to build a position.

Key Takeaways for 2026:

- Volatility is lower: Institutional presence has dampened the “wild west” swings.

- Macro is King: Watch the USD index (DXY) for price clues.

- Support is strong: The $60k zone appears to be a major psychological floor.

The bitcoin price prediction 2026 concludes that while we may not see a new all-time high every month, the underlying health of the network makes it a cornerstone of any modern investment portfolio.