Top DeFi Projects Revolutionizing Finance in 2025

Decentralized Finance (DeFi) has become a major driving force in the blockchain and cryptocurrency industry, reshaping the way people think about money, investment, and finance. By eliminating intermediaries and leveraging blockchain technology, DeFi projects offer transparency, accessibility, and innovation that traditional systems cannot match.

Table of Contents

What Are DeFi Projects?

DeFi projects refer to decentralized applications (dApps) built on blockchain platforms like Ethereum, Binance Smart Chain, and Solana, aiming to provide financial services without centralized authorities. These services include lending, borrowing, trading, staking, yield farming, and more.

Key characteristics of Decentralized Finance projects include:

- Transparency: All transactions are recorded on public ledgers.

- Accessibility: Anyone with an internet connection can participate.

- Security: Smart contracts execute operations without the need for intermediaries.

By addressing inefficiencies in the traditional financial system, DeFi projects empower users to take control of their assets and financial decisions.

Top Decentralized Finance Projects to Watch in 2025

1. Aave

Aave is a leading DeFi protocol that facilitates lending and borrowing without intermediaries. Users can deposit their assets into liquidity pools to earn interest or borrow against their holdings. Aave’s flash loans and multi-collateral support make it a standout project in the Decentralized Finance space.

2. Uniswap

As one of the first decentralized exchanges (DEXs), Uniswap enables users to trade cryptocurrencies directly from their wallets. Its automated market-making (AMM) model and significant liquidity pools have made it a cornerstone for Decentralized Finance projects.

3. MakerDAO

MakerDAO’s stablecoin, DAI, is a pivotal part of the DeFi ecosystem. Unlike centralized stablecoins, DAI is backed by smart contracts, ensuring decentralization and stability. MakerDAO’s governance model allows token holders to participate in decision-making processes.

4. Curve Finance

Specializing in stablecoin trading, Curve Finance offers users low-slippage transactions and high-yield opportunities. It is a favorite among liquidity providers and traders, contributing to its success as a leading DeFi project.

5. Yearn Finance

Yearn Finance simplifies yield farming by automating strategies for maximum returns. Its user-friendly interface and innovative features have made it a popular choice for both beginners and seasoned DeFi enthusiasts.

Innovations Driving the Growth of Decentralized Finance Projects

1. Cross-Chain Interoperability

One major advancement in 2025 is the rise of cross-chain solutions. DeFi projects now utilize bridges to connect blockchains like Ethereum, Binance Smart Chain, and Polkadot, enabling seamless asset transfers.

2. Layer-2 Scaling Solutions

Scalability has been a significant challenge for DeFi projects. Layer-2 solutions like Optimism and Arbitrum address this by reducing transaction costs and increasing throughput, enhancing user experience.

3. Tokenization of Real-World Assets

Tokenizing assets such as real estate, stocks, and commodities has opened new avenues for DeFi projects. These innovations bring traditional assets onto the blockchain, increasing liquidity and accessibility.

4. Decentralized Identity and Privacy

With rising concerns about privacy, Decentralized Finance projects are integrating decentralized identity solutions. Privacy-focused protocols like Tornado Cash are gaining traction for their ability to anonymize transactions.

Challenges Faced by DeFi Projects

Despite their potential, Decentralized Finance projects face several challenges:

1. Security Vulnerabilities

Smart contract bugs and exploits have led to significant financial losses in the DeFi space. Projects must prioritize audits and robust development practices.

2. Regulatory Uncertainty

The global regulatory landscape for Decentralized Finance projects is still evolving. Ambiguity regarding compliance poses risks for developers and users alike.

3. User Education

Many users struggle to understand the technical aspects of DeFi projects, creating barriers to entry. Simplified interfaces and educational initiatives are crucial.

4. Scalability Issues

Although Layer-2 solutions have helped, the scalability of major blockchains like Ethereum remains a challenge for DeFi projects seeking mass adoption.

The Role of DeFi Projects in Financial Inclusion

One of the most significant contributions of Decentralized Finance projects is their role in promoting financial inclusion. Traditional banking systems often exclude individuals due to high fees, lack of infrastructure, or rigid requirements.

DeFi projects eliminate these barriers by enabling users to access financial services with just an internet connection. For example:

- Microloans: Platforms like Aave allow small-scale lending, helping underserved communities.

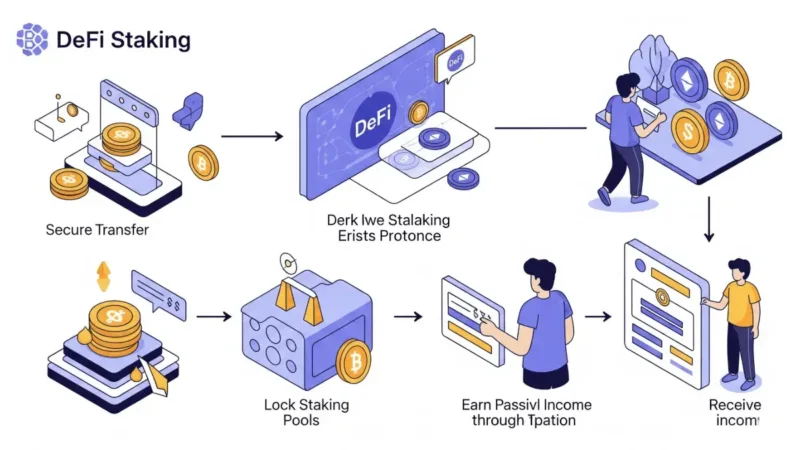

- Savings and Investments: Yield farming and staking options offer lucrative opportunities for individuals in developing countries.

- Peer-to-Peer Transactions: Decentralized exchanges facilitate borderless trade without hefty fees.

How to Get Started with DeFi Projects

For newcomers, navigating the world of Decentralized Finance projects can be daunting. Here’s a step-by-step guide to get started:

1. Choose a Wallet

Select a secure, non-custodial wallet like MetaMask or Trust Wallet. These wallets enable you to interact with DeFi projects directly.

2. Fund Your Wallet

Purchase cryptocurrency from a trusted exchange and transfer it to your wallet. Ethereum is commonly used in many DeFi projects.

3. Explore Platforms

Start by exploring user-friendly platforms like Uniswap or Aave. Research the features and benefits of different DeFi projects before committing funds.

4. Stay Informed

Follow crypto news and updates to understand trends and new opportunities in DeFi projects. Platforms like DeFi Pulse provide insights into market performance.

The Future of Decentralized Finance Projects

The future of DeFi projects looks promising as technology continues to advance. Here are some predictions for 2025 and beyond:

1. Institutional Adoption

More institutions are expected to adopt DeFi protocols, bridging the gap between traditional finance and decentralized ecosystems.

2. Integration with AI

Artificial intelligence is poised to enhance DeFi projects through smarter decision-making algorithms, fraud detection, and improved user experience.

3. Sustainability Initiatives

Eco-friendly DeFi projects will focus on minimizing the carbon footprint of blockchain operations, addressing environmental concerns.

Stay informed, read the latest crypto news in real time!

Conclusion

DeFi projects are revolutionizing the financial industry by providing decentralized, transparent, and accessible solutions. From lending protocols to decentralized exchanges, these projects offer innovative ways to manage assets, earn yields, and participate in the global economy.

As the DeFi ecosystem continues to evolve, its impact on financial inclusion, innovation, and global connectivity will only grow. Stay informed and explore the potential of these transformative technologies as they redefine the future of finance.

By focusing on security, scalability, and user education, Decentralized Finance projects are well-positioned to lead the financial revolution in the coming years.