Crypto Bubbles: Understanding Market Hype and Its Consequences

The world of cryptocurrency is known for its extreme price volatility, where assets can skyrocket in value one day and crash the next. One of the key phenomena responsible for these dramatic shifts is Crypto Bubbles. Similar to stock market bubbles, these events occur when digital assets become overvalued due to hype, speculation, and market sentiment rather than intrinsic value.

What Are Crypto Bubbles?

A Cryptocurrency bubble occurs when the price of a cryptocurrency inflates rapidly, far beyond its real-world value, due to market speculation. As more investors jump on board hoping to make quick profits, the price continues to rise—until it eventually collapses, leaving many with significant losses.

Key Characteristics of Crypto Bubbles:

- Excessive Speculation: Investors buy crypto assets purely based on hype rather than solid fundamentals.

- Rapid Price Increases: Prices surge within a short period, often reaching all-time highs.

- FOMO (Fear of Missing Out): Many investors rush to buy, fearing they will miss out on potential profits.

- Sharp and Sudden Crashes: After reaching an unsustainable peak, the asset’s price plummets just as fast.

Major Crypto Bubbles in History

Several Crypto Bubbles have occurred in the past decade, showcasing how quickly market hype can turn into panic selling.

Bitcoin’s 2017 Bubble

Bitcoin’s price surged from around $1,000 in January 2017 to nearly $20,000 by December of the same year. This meteoric rise was fueled by retail investors, media hype, and speculative trading. However, by early 2018, the price collapsed to below $4,000, wiping out billions in market value.

The ICO Bubble (2017-2018)

During the same period, Initial Coin Offerings (ICOs) became wildly popular, with investors pouring money into new blockchain projects. Many of these projects turned out to be scams or failed ventures, leading to massive financial losses when the Crypto Bubble burst in 2018.

Dogecoin and Meme Coin Frenzy (2021)

Originally created as a joke, Dogecoin gained mainstream attention when high-profile figures like Elon Musk tweeted about it. The price soared from fractions of a cent to over $0.70 but later crashed, proving that even meme coins are not immune to Crypto Bubbles.

NFT Mania (2021-2022)

The rise of Non-Fungible Tokens (NFTs) created another speculative market bubble. Digital artwork, collectibles, and virtual real estate were sold for millions of dollars. However, as demand declined, many NFT projects saw their values drop by over 90%, demonstrating yet another instance of Crypto Bubbles forming and bursting.

What Causes Crypto Bubbles?

Several factors contribute to the formation of Crypto Bubbles, making them a recurring phenomenon in the market.

1. Speculation and Hype

When investors believe an asset will continue rising in value, they invest based on speculation rather than fundamentals. Social media, influencers, and financial news channels often fuel this excitement.

2. FOMO (Fear of Missing Out)

Many investors jump into the market without proper research, fearing they will miss out on massive profits. This collective rush further inflates prices.

3. Limited Market Regulation

Unlike traditional financial markets, the crypto industry remains largely unregulated in many countries. This lack of oversight allows for price manipulation, pump-and-dump schemes, and fraudulent projects that contribute to Crypto Bubbles.

4. Institutional Influence

When large institutions or high-profile investors promote a particular cryptocurrency, prices can skyrocket overnight. However, when these institutions sell off their holdings, the market crashes just as quickly.

5. Technological Advancements and Market Trends

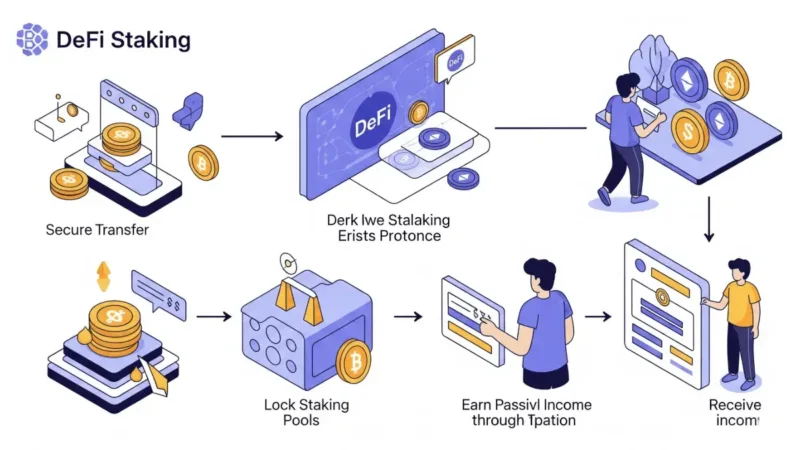

New blockchain technologies and financial models (such as DeFi, NFTs, and metaverse projects) often create short-term hype, leading to overvalued assets that later decline when the excitement fades.

How to Identify a Crypto Bubble

While it is difficult to predict exactly when a Crypto Bubble will burst, certain warning signs can help investors spot potential risks.

1. Unreasonable Price Increases

If a cryptocurrency’s price rises dramatically within days or weeks without any real-world utility improvement, it could indicate a bubble.

2. Celebrity and Influencer Endorsements

A surge in celebrity or influencer endorsements without fundamental backing is often a red flag. Many investors blindly follow public figures without understanding the risks.

3. Extreme Market Hype

If everyone is talking about a cryptocurrency and it’s being promoted as a “guaranteed” way to make money, caution is advised.

4. Overleveraged Trading

When investors use borrowed funds (leverage) to trade, it artificially inflates prices. When the market turns, forced liquidations can lead to rapid price collapses.

5. Lack of Fundamental Value

Many overhyped crypto projects lack real-world use cases or sustainable business models. If a cryptocurrency is being promoted solely for its price potential, it could be part of a Crypto Bubble.

How to Protect Yourself from Crypto Bubbles

Investing in cryptocurrency can be profitable, but understanding how to navigate Crypto Bubbles is crucial for long-term success.

1. Do Your Own Research (DYOR)

Before investing, research the project’s technology, team, and real-world applications. Avoid projects that rely solely on hype.

2. Diversify Your Portfolio

Don’t put all your money into a single asset. A diversified crypto portfolio can reduce risks associated with market bubbles.

3. Avoid Emotional Trading

Fear and greed often lead to poor investment decisions. Stick to a well-planned strategy rather than making impulsive trades.

4. Use Stop-Loss Orders

Setting stop-loss orders can help minimize losses by automatically selling assets when prices drop below a certain level.

5. Take Profits Regularly

Instead of holding onto assets indefinitely, consider taking profits when prices reach unrealistic highs. This approach ensures you secure gains before the bubble bursts.

Stay informed, read the latest crypto news in real time!

Conclusion

The cryptocurrency market is filled with opportunities, but it also carries significant risks. Crypto Bubbles are an unavoidable part of this ecosystem, and while they can generate substantial profits, they can also lead to devastating losses. Understanding the causes, warning signs, and protective strategies can help investors make informed decisions and navigate the volatile world of crypto investing.

By staying informed, conducting thorough research, and avoiding market hysteria, investors can better protect themselves from the negative impacts of Crypto Bubbles.