Chainlink Labs : The United States’ Path to Leading the Tokenization Revolution

The financial world stands on the cusp of a profound transformation, driven by the burgeoning potential of blockchain technology and, more specifically, asset tokenization. This revolutionary process, which involves converting real-world assets into blockchain-based digital tokens, is rapidly gaining traction, with projections indicating a staggering $16 trillion market by 2030. Amidst this global race for dominance, Chainlink Labs believes that the United States possesses the unique combination of infrastructure, capital, and innovation to emerge as the undisputed leader. However, achieving this leadership requires a concerted effort to fully embrace and integrate this cutting-edge technology into the nation’s financial fabric.

Understanding the Tokenization Phenomenon

At its core, tokenization is about digitizing ownership and rights. Imagine your property deed, a share of stock, a piece of art, or even a bar of gold, transformed into a digital token on a blockchain. This token represents verifiable ownership, can be fractionalized, traded instantly, and managed with unprecedented transparency and efficiency. The implications for liquidity, accessibility, and operational costs across various asset classes are immense. By streamlining cumbersome traditional processes, tokenization promises to unlock trillions in value, making previously illiquid assets tradable and democratizing investment opportunities on a global scale. This shift is not merely an incremental improvement; it’s a paradigm change, promising to redefine how value is stored, transferred, and governed.

The current financial system, while robust, is plagued by inefficiencies, high costs, and fragmented infrastructure. Cross-border payments are slow and expensive, asset transfers involve multiple intermediaries, and settlement often takes days. Tokenization, leveraging the inherent properties of blockchain—immutability, transparency, and programmability—offers a compelling alternative. It can enable near-instantaneous settlement, reduce counterparty risk through smart contracts, and provide a single, verifiable source of truth for asset ownership. For the United States, a nation built on robust capital markets and a history of financial innovation, seizing this opportunity is not just about staying competitive; it’s about shaping the future of global finance.

The United States: Poised for Leadership?

A recent report from Chainlink Labs’ Government Affairs team delved deep into this potential, asserting that “the United States is uniquely positioned to lead, thanks to its deep capital markets, top-tier global financial institutions, and history of innovation in financial infrastructure.” This assessment is not without merit. The sheer depth and sophistication of U.S. capital markets, coupled with the presence of global financial giants and a culture of technological advancement, create a fertile ground for the tokenization revolution to flourish. The U.S. has historically been at the forefront of financial innovation, from the development of modern stock exchanges to the widespread adoption of digital payments. This legacy of adaptability and pioneering spirit is a significant asset in the race to define the next generation of financial infrastructure.

However, the path to leadership is not without its obstacles. While the U.S. dollar overwhelmingly dominates the stablecoin market—accounting for over 99% of the $210 billion market—much of the underlying infrastructure for these stablecoins operates outside U.S. borders. This creates a paradoxical situation where the dollar’s influence is significant, but the technological backbone supporting its digital representation often resides offshore. This highlights a critical need for the U.S. to not only encourage innovation but also to foster the development of robust, compliant, and domestically anchored blockchain infrastructure. Without this foundational shift, the U.S. risks ceding control and influence over the very technologies that are reshaping global finance.

The Stablecoin Precedent and Beyond

The prevalence of dollar-pegged stablecoins serves as a crucial early indicator of blockchain’s potential impact on finance. Just as email was the internet’s initial killer application, proving the utility of digital communication, stablecoins are the first major use case demonstrating the efficiency of digital assets for value transfer. They offer a taste of a future where traditional currencies can be moved with the speed and programmability of digital native assets. This early success provides a strong foundation, but it’s merely the beginning.

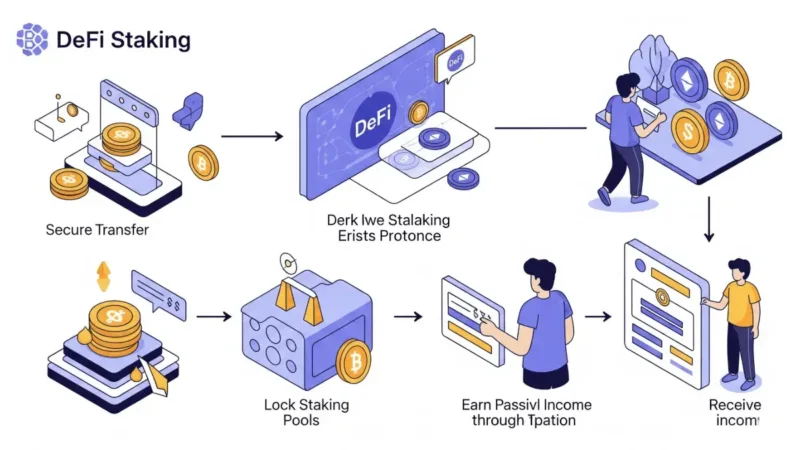

The evolution of decentralized finance (DeFi) represents the next frontier. DeFi extends the promise of blockchain beyond simple digital currency transfers, envisioning a global, neutral financial layer that offers a vast array of services: lending, borrowing, trading, and asset management, all without traditional intermediaries. This paradigm shift offers unprecedented transparency, accessibility, and efficiency. However, as DeFi pushes the boundaries of financial innovation, it simultaneously brings into sharp focus one of the most significant challenges for broader adoption: compliance.

For tokenized assets to achieve widespread, institutional adoption, compliance cannot be an afterthought; it must be an integral, automated component of the asset itself. This means embedding regulatory requirements, identity verification, and jurisdictional rules directly into the token’s DNA. Manual, retrospective compliance processes, which characterize traditional finance, are simply not scalable for a future where assets move globally and instantly on blockchains. The ability to programmatically enforce compliance rules and monitor transactions in real-time is paramount for building trust among regulators, institutions, and users alike.

Paving the Way for US Leadership: Clarity, Confidence, and Coordination

While countries like Singapore, Switzerland, and the UAE have made significant strides in establishing regulatory frameworks and fostering innovation in the tokenization space, the U.S. still has a strong opportunity to take the lead. This leadership, however, hinges on three critical pillars: clarity, confidence, and coordination. Regulatory clarity is perhaps the most urgent need, as uncertainty stifles innovation and drives talent and capital to more welcoming jurisdictions. A clear, consistent, and forward-thinking regulatory framework would provide the necessary guidance for businesses to build and operate within the U.S., fostering confidence among investors and institutions.

To remain competitive, the U.S. must also champion the development of tokenized financial products that are not only reliable and secure but also offer unparalleled ease of use, real-time settlement, and transparent tracking. This involves investing in robust infrastructure, encouraging public-private partnerships, and fostering an environment where innovation can thrive within defined regulatory boundaries. The goal is to create a vibrant ecosystem where institutional players feel secure and retail investors can participate confidently.

The Role of Identity Oracles and Unified Golden Records

Achieving this level of trust and operational efficiency requires sophisticated technological solutions. One crucial component is the use of identity oracles. These oracles act as bridges between the off-chain world of traditional identity verification and the on-chain realm of blockchain. By providing verifiable on-chain proof of essential user information—such as Know Your Customer (KYC) and Anti-Money Laundering (AML) verification, investor accreditation status, and geographic eligibility—identity oracles bring a critical layer of trust and compliance to the system. They enable tokenized assets to be governed by real-world rules, ensuring that only authorized participants can engage in specific transactions or hold certain assets. This is vital for preventing illicit activities and ensuring market integrity.

However, identity oracles are just one piece of a larger, more comprehensive solution. The ultimate breakthrough lies in the creation of a “unified golden record.” This concept envisions a smart data container that aggregates and securely manages all critical information associated with a tokenized asset. This includes ownership details, a comprehensive history of transactions, embedded compliance requirements, real-time pricing information, and any other relevant metadata. The beauty of a unified golden record is its dynamism: it’s continuously updated, easy to verify on-chain, and transparently visible to authorized regulators and market participants in real-time. This level of transparency and data integrity is precisely what is needed to facilitate large-scale tokenization across diverse asset classes and jurisdictions. It moves beyond fragmented, siloed data systems to a single, authoritative source of truth.

Chainlink: The Infrastructure for a Tokenized Future

When it comes to transforming this vision into reality, Chainlink Labs stands out as a critical enabler. According to a 2024 report, Chainlink is currently the only platform that supports all the capabilities required for these sophisticated, unified records. Its suite of decentralized oracle networks provides the secure and reliable off-chain data feeds necessary to power these smart data containers, ensuring they remain accurate and up-to-date. This unique capability positions Chainlink as foundational infrastructure for the next generation of financial markets.

Furthermore, a significant challenge in the broader adoption of blockchain technology is interoperability. The blockchain ecosystem is characterized by multiple, often isolated, networks. Locking tokenized assets and their associated data onto a single blockchain would severely limit their utility and market reach. Recognizing this, Chainlink Labs developed the Cross-Chain Interoperability Protocol (CCIP). CCIP is a groundbreaking solution that enables tokenized assets and their data to move freely and securely between different blockchains. This secure, decentralized messaging and transfer protocol is essential for fostering a truly interconnected and liquid tokenized asset market. It acts as the “internet of blockchains,” allowing value and information to flow seamlessly across disparate networks, much like data flows across the internet.

The impact and adoption of Chainlink’s technology are already profound. Chainlink’s CCIP is currently securing more than $18 trillion in on-chain value, a figure that astonishingly rivals the entire U.S. GDP. This massive amount of value secured underscores the trust and reliability that the financial industry places in Chainlink’s infrastructure. It’s a testament to the robust security, decentralization, and proven performance of its oracle networks and cross-chain capabilities. The fact that such significant capital is already flowing through and being secured by Chainlink’s protocols highlights its crucial role in the nascent tokenized economy. This is not just about building tech; it’s about building the foundational layers that will enable the U.S. to back and lead this financial revolution.

Stay informed, read the latest crypto news in real time!

In conclusion, the tokenization revolution presents an unparalleled opportunity for the United States to reaffirm its position as a global financial leader. By addressing regulatory clarity, fostering innovation, and leveraging advanced technologies like Chainlink’s identity oracles, unified golden records, and CCIP, the U.S. can build a secure, efficient, and compliant digital asset ecosystem. The future of finance is increasingly digital and tokenized, and the nation that embraces this reality with confidence and coordination will undoubtedly reap the immense economic benefits. Chainlink Labs remains a steadfast partner in this endeavor, providing the critical infrastructure to make this transformative vision a tangible reality.